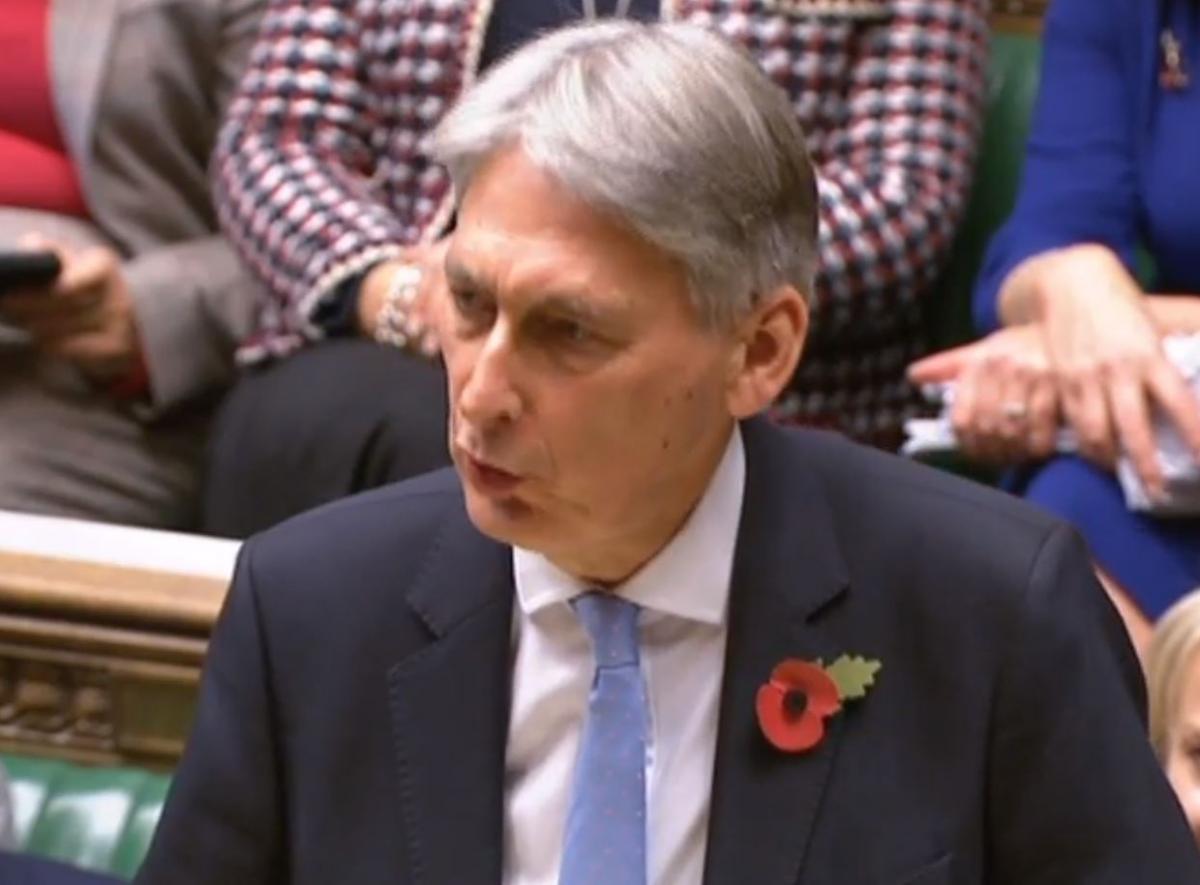

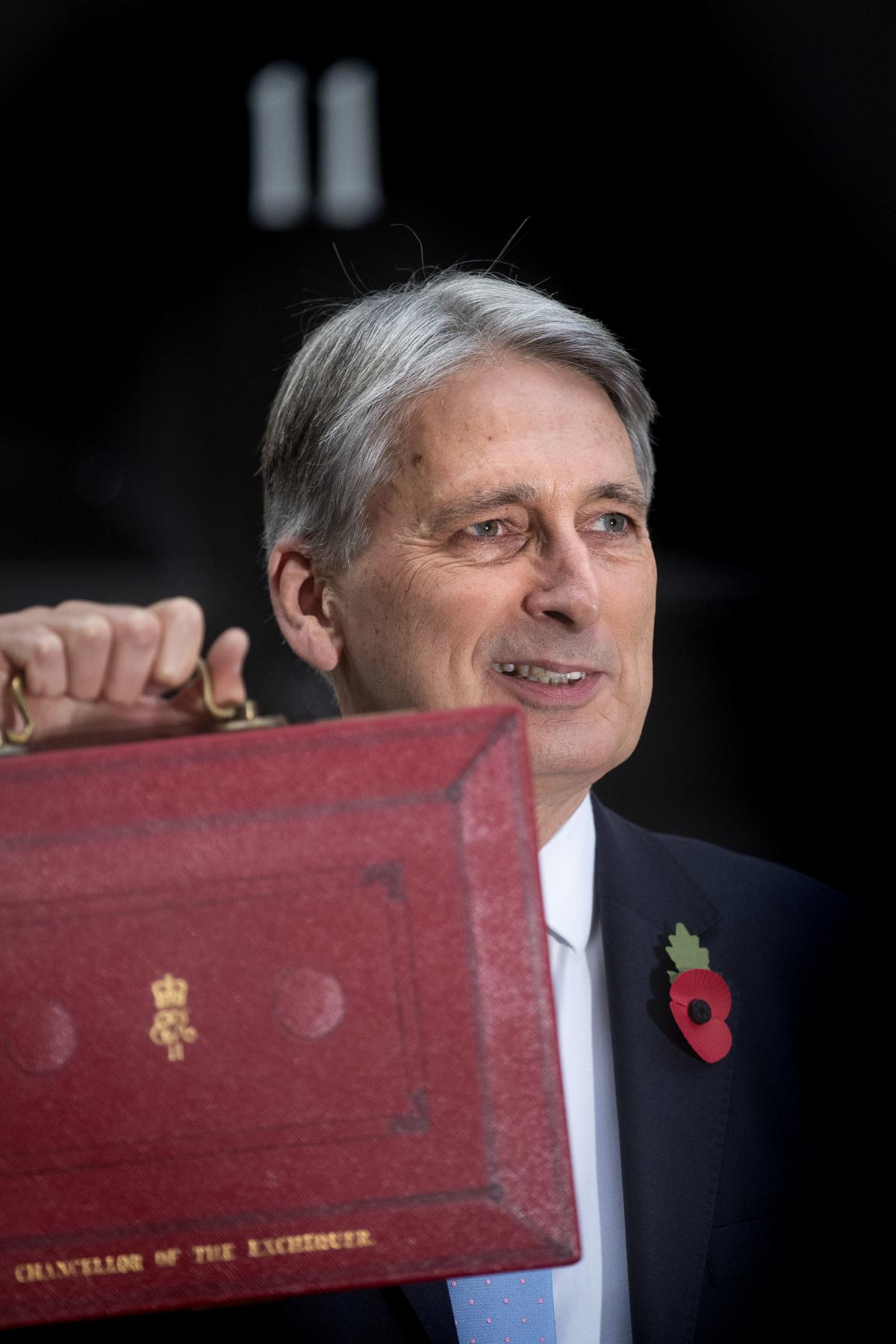

CHANCELLOR Philip Hammond promised a Budget for “the strivers, the grafters and the carers” as he set out his tax and spending plans.

In his last scheduled budget before Brexit, Mr Hammond promised his proposals would pave the way for a “brighter future”.

His comments come after Prime Minister Theresa May promised she was ending years of austerity.

He told MPs in the Commons: “The era of austerity is finally coming to an end.”

Among those projects announced were:

- £10million to help veterans with mental health illnesses to mark the centenary of the end of the First World War

- £10million funding for the Air Ambulance

- £420million immediate funding for local authorities to help potholes and bridge repairs

- A one off payment averaging £10,000 to each primary school and £50,000 to each secondary school.

Borrowing this year will be £11.6 billion lower than forecast at the Spring Statement, at 1.2 per cent of GDP, and is then set to fall from £31.8bn in 2019/20 to £26.7bn in 2020/21, £23.8bn in 2021/22, £20.8bn in 2022/23 and £19.8bn in 2023/24.

Downing Street has insisted the budget’s spending announcements are fully funded, regardless of whether the UK secures a Brexit deal.

In his Budget statement, Mr Hammond said he was setting aside an extra £500 million for Brexit preparations, adding: “If the economic or fiscal outlook changes materially in-year, I reserve the right to upgrade the Spring Statement to a full Fiscal Event.”

Speaking in the Commons Mr Hammond said he was promising a “Budget for hard-working families” and told MPs: “We have reached a defining moment on this long, hard journey” after repairing the damage to the public finances caused by the financial crash.

There was good news for pubs as well, as duty on beer, cider and spirits was frozen for the next year, saving 2p on a pint of beer, 1p on a pint of cider, and 30p on a bottle of Scotch or gin.

Duties on wine are to rise in line with retail price index inflation while white ciders - often high ABV drinks consumed by street drinkers - are to be taxed at a new higher rate.

One of the major announcements in the Commons was the plan to cut business rates for the next two years by a third.

The relief will be given to those retailers, whether they be a cafe, restaurant, shop or pub, with a rateable value of £51,000 or less.

It is estimated it could save businesses £8,000.

Mr Hammond added rental values will be readdressed in 2021.

David Burch, director of policy at Essex Chambers of Commerce, said: “We’re delighted that the Chancellor has heeded the British Chambers of Commerce calls to abandon the uprating of business rates for the high street for the next two years, and gone further by cutting bills for the vast majority of high street firms.

“It’s crucial that we support our town centres as they find their place in a changing world.

“An alarming number of high street firms, both large and small, are closing or being earmarked for closure.

“This deterioration has cost thousands of jobs since the start of 2018.

“While there are long-term structural changes taking place, including changes to consumer habits, the tipping point for many of these firms has been the unnecessarily large burden that business rates place on them.

“Therefore, this short-term reduction in rates will be very welcome news to those on the high street who require urgent respite.”

The business expert added: “Business rates are a heavy burden that throttle all firms with steep bills regardless of how well they’re doing or the economy is faring.

“We have also called on the Chancellor to ensure that all businesses have a 12 month delay on increased business rate bills when improving an existing property or moving to a new premises.

“In the long term we will continue to call for fundamental reform of the broken business rates system.”

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules hereLast Updated:

Report this comment Cancel