THE elderly and vulnerable will have vital services torn from them if a high street banking branch closes, an MP has said.

HSBC has announced that it will be closing its branch in High Street, Billericay, later this year, amid a slate of closures around the country

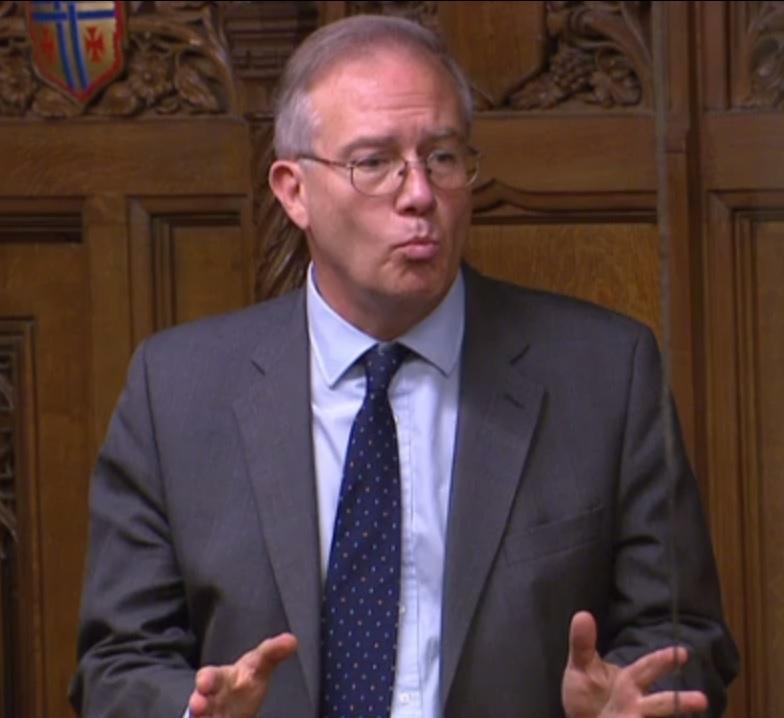

Basildon and Billericay MP John Baron is leading a campaign to save the branch from closure.

He said: “The nearest alternative branch is nearly five miles away which will prove problematic for elderly and vulnerable customers who rely on in-branch services to manage their money. Furthermore, the town’s population is increasing.

“I have written to the Chief Executive of HSBC asking them to change their decision and will be meeting with the local management team.”

Banking closures - John Baron

If the September closure goes ahead, Billericay's nearest HSBC branch will be in either Brentwood or Basildon.

Councillor Andrew Schrader said: “As the local ward councillor, I very much share John's concerns.

“H.S.B.C. are, of course, not unique and they are not the first bank to close their local branch, which are fast becoming an endangered species in a great many high streets.

“I think I broadly recognise that, for the banks, much has changed. HSBC says that over the past five years the number of customers using branches has fallen by a third, nine in ten customers now do their banking online or over the phone, and 99 per cent of all cash withdrawals are made at a cashpoint. So, these trends were already well-established, even before the Covid-19 pandemic.”

In total the banking giant is looking to axe 69 branches across the country.

It follows 82 HSBC branches closing last year and 27 the year before that in 2020.

Jackie Uhi, Head of HSBC UK’s Branch Network, said: “The way people bank is changing - something the pandemic has accelerated.

“We know that the majority of our customers have a preference to do much of their day-to-day banking online or via mobile, so we’re removing locations where we have another branch nearby, and where there is a significant reduction in customers using face-to-face branch servicing.”

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules hereLast Updated:

Report this comment Cancel