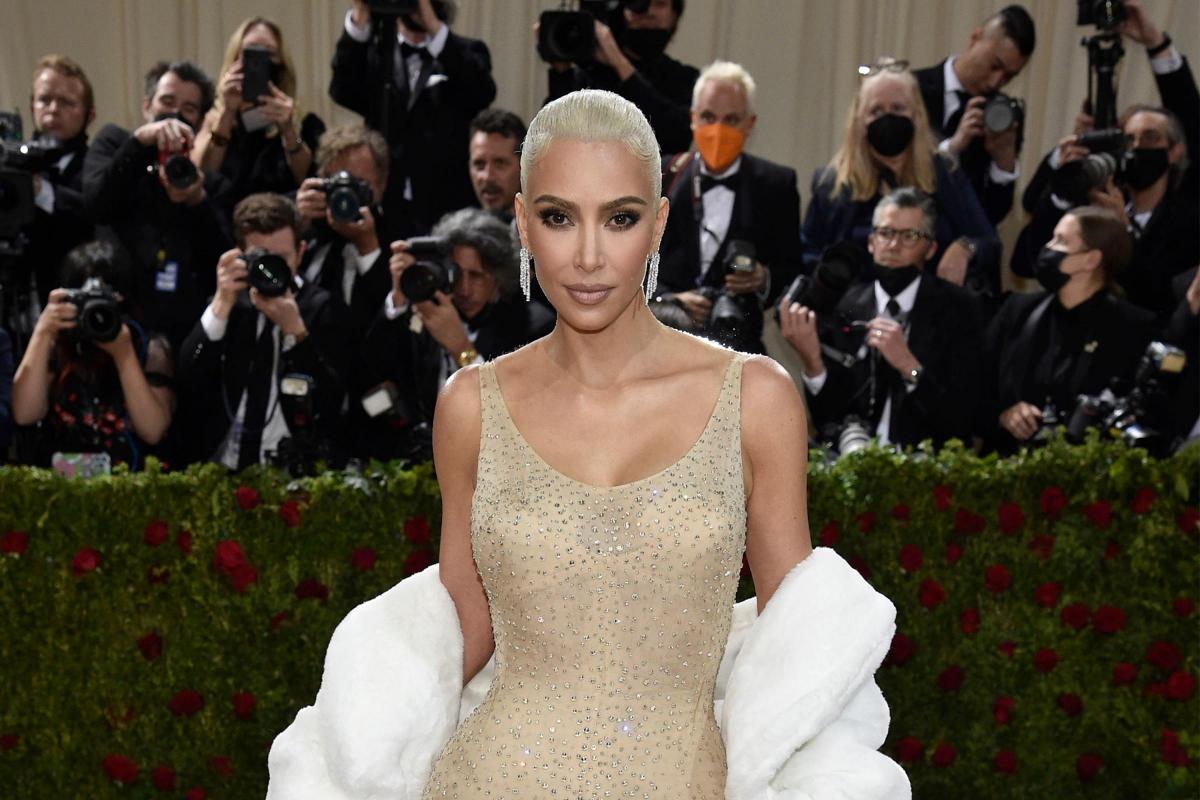

Kim Kardashian has agreed to settle charges brought by the US Securities and Exchange Commission (SEC) and pay 1.26 million dollars (£1.1 million) in penalties for promoting a cryptocurrency on social media without disclosing the payment she received for it.

The SEC said that the reality TV star and entrepreneur has agreed to cooperate with its ongoing investigation.

The agency declined to comment on the ongoing investigation.

The agency said Kardashian failed to disclose that she was paid 250,000 dollars (£222,000) to publish a post on her Instagram account about EMAX tokens, a crypto asset security being offered by EthereumMax.

Kardashian’s post contained a link to the EthereumMax website, which provided instructions for potential investors to purchase EMAX tokens.

Gurbir Grewal, director of the SEC’s division of enforcement, said in a prepared statement: “The federal securities laws are clear that any celebrity or other individual who promotes a crypto asset security must disclose the nature, source, and amount of compensation they received in exchange for the promotion.”

Kardashian has agreed to not promote any crypto asset securities for three years.

A lawyer for Kardashian said in an email: “Ms Kardashian is pleased to have resolved this matter with the SEC. Kardashian fully cooperated with the SEC from the very beginning and she remains willing to do whatever she can to assist the SEC in this matter.

“She wanted to get this matter behind her to avoid a protracted dispute. The agreement she reached with the SEC allows her to do that so that she can move forward with her many different business pursuits.”

While Kardashian is well known for reality TV, currently appearing on The Kardashians on Hulu, she is also a successful businesswoman.

Her brands include SKIMS, which has shapewear, loungewear and other products, and a skincare line called SKKN.

Today we announced charges against Kim Kardashian for promoting a crypto security offered by EthereumMax without disclosing the payment she received for the promotion.

Kardashian agreed to settle the charges, pay $1.26 million, and cooperate with the investigation.

— U.S. Securities and Exchange Commission (@SECGov) October 3, 2022

Cryptocurrency has attracted increasing attention from US congress. A bipartisan proposal last month would hand the regulatory authority over Bitcoin and Ether, two popular cryptocurrencies, to the Commodities Futures Trading Commission after wild swings in crypto valuations, dozens of scams and hundreds of billions of dollars gained and lost.

Kardashian is not the first celebrity to attract the attention of regulators for their involvement in cryptocurrency.

In 2018, the agency settled charges against professional boxer Floyd Mayweather Jr and music producer DJ Khaled for failing to disclose payments they received for promoting investments in digital currency.

SEC chair Gary Gensler said: “This case is a reminder that, when celebrities or influencers endorse investment opportunities, including crypto asset securities, it doesn’t mean that those investment products are right for all investors.

“We encourage investors to consider an investment’s potential risks and opportunities in light of their own financial goals.”

Mr Gensler added: “Ms Kardashian’s case also serves as a reminder to celebrities and others that the law requires them to disclose to the public when and how much they are paid to promote investing in securities.”

This year, crypto investors have seen prices plunge and companies crater with fortunes and jobs disappearing overnight, and some firms have been accused by federal regulators of running an illegal securities exchange.

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules here